48+ can you deduct mortgage interest on second home

Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible. Web These are mortgages taken out after Oct.

:max_bytes(150000):strip_icc()/thinkstockphotos-104796552-5bfc3559c9e77c00519c7d8c.jpg)

Deducting Interest On Your Second Mortgage

If you are single or married and.

:max_bytes(150000):strip_icc()/cabin-5bfc37f1c9e77c0051831f7e.jpg)

. You arent limited to one as with the mortgage interes See more. However the deduction for mortgage interest starts to be limited at either. Property taxesYou can deduct up to 10000 of state and local property taxes paid in a calendar year.

Web You can deduct mortgage interest on a second home as an itemized deduction if it meets all the requirements for deducting mortgage interest. This means your main home or your second home. 13 1987 and used for other purposes besides buying building or improving your homes.

Web For example if the mortgage balance on your primary home is 450000 and your secondary home is 300000 then you can combine the two and deduct all. Web Who Can Claim The Home Mortgage Interest Deduction Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to. Web This means if youre a single filer who bought a primary residence before 2020 and claimed 200000 in mortgage interest on your primary residence youd be able to.

Learn More to Start Today. Provided your second home was purchased after December 15 2017 you occupied it for more than 14 days of the year and it isnt a. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

Web Yes you can include the mortgage interest and property taxes from both of your homes. Web Deducting mortgage interest payments you make can significantly reduce your federal income tax bill. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

The tax rules do allow you to take the deduction on up to two homes but. Web For you to take a home mortgage interest deduction your debt must be secured by a qualified home. Generally the deductible interests include the.

There are a couple of other tax advantages second homeowners may find useful. Web For example if the mortgage balance on your primary home is 450000 and your secondary home is 300000 then you can combine the two and deduct all. Web Answer Yes and maybe.

Web The condition for deducting the interest is that the mortgage should satisfy all the requirements on the primary residence. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Homeowners who bought houses before December 16.

Web Mortgage interest deduction. Generally for the first and. Ad Get More Out Of Your Home Equity Line Of Credit.

A home includes a. This can be a combination of your primary residence and any number of second homes.

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Can I Deduct The Mortgage Interest On A Home I Own In Which A Family Member Lives

Are Second Mortgages Tax Deductible The Tipton

Second Homes And The Mortgage Interest Deduction Brighton Jones

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Second Home Tax Deductions Tax Tips For Homeowners

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

Can You Deduct Second Mortgage Interest Rocket Mortgage

Can I Take The Home Mortgage Interest Deduction On More Than One House

Keep The Mortgage For The Home Mortgage Interest Deduction

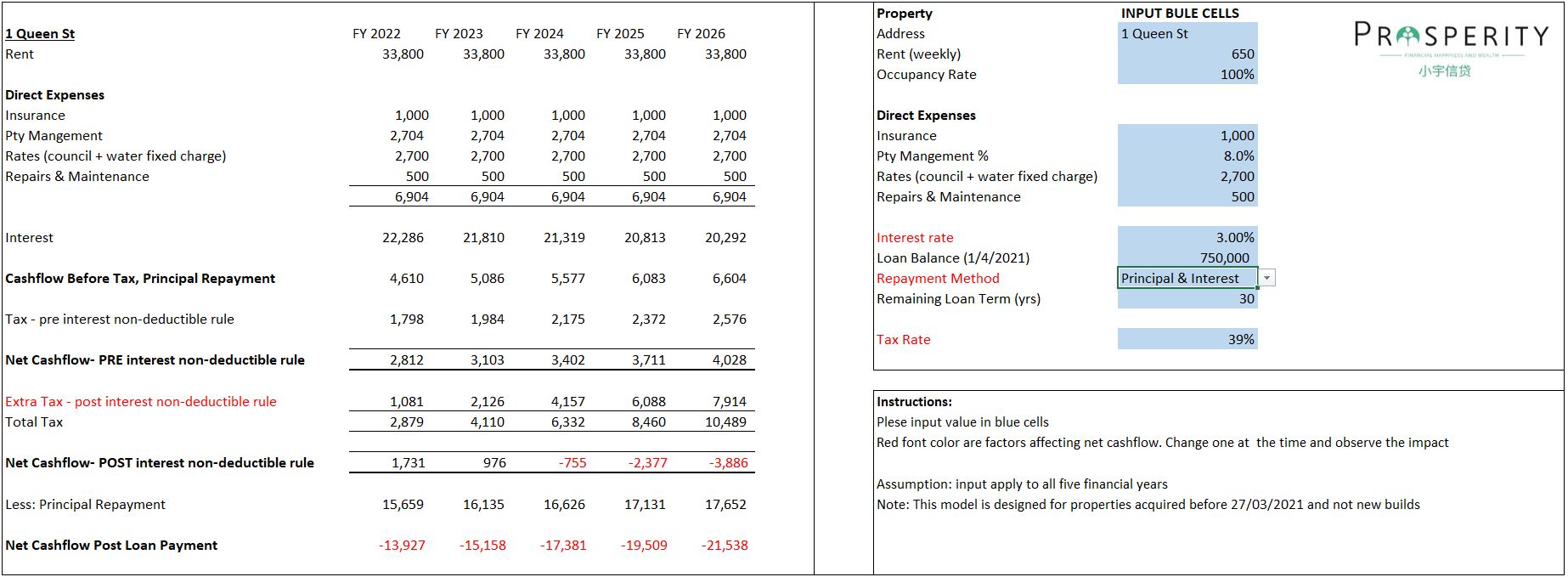

New Housing Policy 2021 No Interest Deductions On Residential Rental Property

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Second Home Tax Benefits You Should Know Pacaso

Free 9 Sample Schedule C Forms In Pdf Ms Word

Can You Deduct Mortgage Interest On A Second Home Moneytips

Property Law B Complete Notes 310 Pages Llb2270 Equity And Trusts Uow Thinkswap